Embrace Harmony and Simplicity with Japandi: The Perfect Interior Design Trend for Your Home

by: Cassie Walker Johnson

Step into the world of Japandi, the latest interior design trend that effortlessly blends the timeless elegance of Japanese minimalism with the warm and cozy elements of Scandinavian design. This fusion of styles creates a harmonious and inviting space that promotes tranquility and simplicity. In this blog post, we will explore the origins of Japandi, delve into its key aspects, provide you with a palette of paint colors to incorporate the trend, and offer a selection of items to decorate your home in this captivating style.

Japandi emerged as a response to the fast-paced and cluttered world we live in, seeking to bring balance, serenity, and a connection to nature into our homes. This design trend finds its roots in two distinct styles: the timeless Japanese aesthetic of Wabi-Sabi, which embraces imperfections and the beauty of natural materials, and the clean lines and functional approach of Scandinavian design, renowned for its simplicity and cozy atmosphere. The marriage of these two styles results in a unique and soothing visual experience.

KEY ASPECTS OF JAPANDI:

Minimalism with Warmth: Japandi embraces the clean lines and uncluttered spaces of minimalism, while adding warm and inviting elements such as natural textures, cozy textiles, and warm lighting.

Natural Materials: In Japandi, natural materials take center stage. Incorporate elements like light-toned wood, bamboo, rattan, and stone to infuse your space with a sense of organic beauty and connection to nature.

Neutral Color Palette: Japandi relies on a soothing, neutral color palette, including shades of white, beige, gray, and earthy tones. These hues create a serene and calming atmosphere, allowing the natural elements to shine.

Functionality and Simplicity: Japandi celebrates the beauty of simplicity and functionality. Furniture and decor pieces are selected with a purpose, ensuring that each item serves both an aesthetic and practical role.

Harmony of Contrasts: Japandi finds beauty in the harmony of contrasting elements. Combining dark and light, smooth and textured, modern and traditional, creates a balanced and visually appealing space.

One of the easiest and most cost effective ways to incorporate Japandi into your home is with a fresh coat of paint. Here are a few of our suggested favorites:

If you would like to add a bit of Japandi to your home, consider starting small, incorporating just a few items into your current design with a seasonal refresh. A few of our current favorites include:

While design trends will come and go, we personally are inspired by the warm tones and simplistic esthetic.

Today we’re diving into an important topic that could make a big difference in the amount of money you net from your home sale.

There is no denying that the Seattle real estate market is hot. There are more buyers who need houses than houses for sale. That means your home is in demand and it’s not even listed yet. This sounds like great news for you, and it is!

As a result, we know what potential sellers are thinking . . . Hmm, maybe we should just put a sign up in the front yard and see what happens.

The truth is, the worst thing you can do as a seller in a hot market is to do it alone. So, before you head to the local hardware store for that "For Sale By Owner" sign, keep reading.

We know you're doing the math and figuring out how much selling your home on your own could potentially save you, but we want to shed some light on a few important things to consider before you decide to go that route.

If you're looking to the internet to determine what price to list your home at, you could be losing a significant amount of money. Online home values aren't always entirely accurate, which means basing your list price on what the internet is saying could result in you leaving money on the table.

Contracts and negotiations can feel like a foreign language if you're not a real estate professional. Not understanding how to navigate this very important information, nor having an advocate working on behalf of your best interest could result in sticky situations and money lost.

When you're in a hot market, one of the greatest benefits to a seller is that they're in the driver's seat. When there are more buyers than listings for sale, your house can spark a bidding war when it hits the market. However, without an agent helping you prep your home for the market, pricing it strategically, and marketing it with professional methods, you're missing out on that demand. You might have a buyer or two but that isn't going to escalate the price like it would if you had someone working for you.

Our best advice we can give to someone thinking about selling is this: before you make the decision to do it alone, do some research and find an agent who has good reviews, comes highly recommended and has known expertise in your city. What does their experience look like? What are their clients saying? Then schedule a consultation with them to see how they can help you net the most money possible from your home sale.

Successful home selling is rooted in doing your research and making smart decisions that are going to position you in the best place possible when your house hits the market.

A recent survey revealed that many consumers believe there’s a housing bubble beginning to form. That feeling is understandable, as year-over-year home price appreciation is still in the double digits. However, this market is very different than it was during the housing crash 15 years ago. Here are four key reasons why today is nothing like the last time.

1. HOUSES ARE NOT UNAFFORDABLE LIKE THEY WERE DURING THE HOUSING BOOM

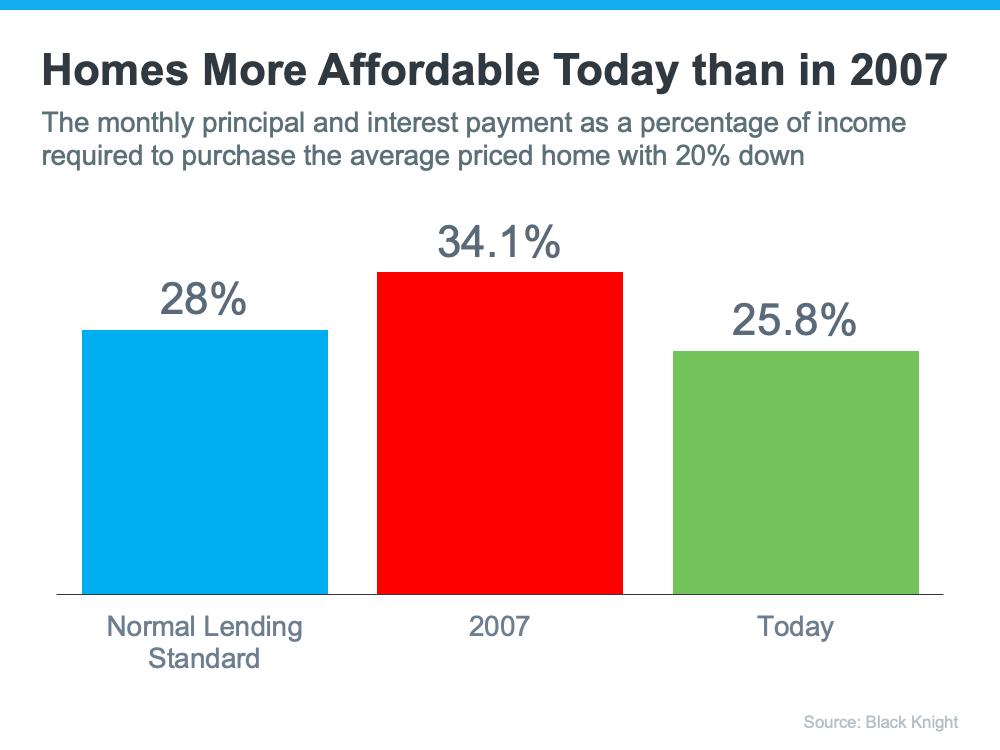

The affordability formula has three components: the price of the home, wages earned by the purchaser, and the mortgage rate available at the time. Conventional lending standards say a purchaser should not spend more than 28% of their gross income on their mortgage payment.

Fifteen years ago, prices were high, wages were low, and mortgage rates were over 6%. Today, prices are still high. Wages, however, have increased, and the mortgage rate, even after the recent spike, is still well below 6%. That means the average purchaser today pays less of their monthly income toward their mortgage payment than they did back then.

In the latest Affordability Report by ATTOM Data, Chief Product Officer Todd Teta addresses that exact point:

“The average wage earner can still afford the typical home across the U.S., but the financial comfort zone continues shrinking as home prices keep soaring and mortgage rates tick upward.”

Affordability isn’t as strong as it was last year, but it’s much better than it was during the boom. Here’s a chart showing that difference:

If costs were so prohibitive, how did so many homes sell during the housing boom?

2. MORTGAGE STANDARDS WERE MUCH MORE RELAXED DURING THE BOOM

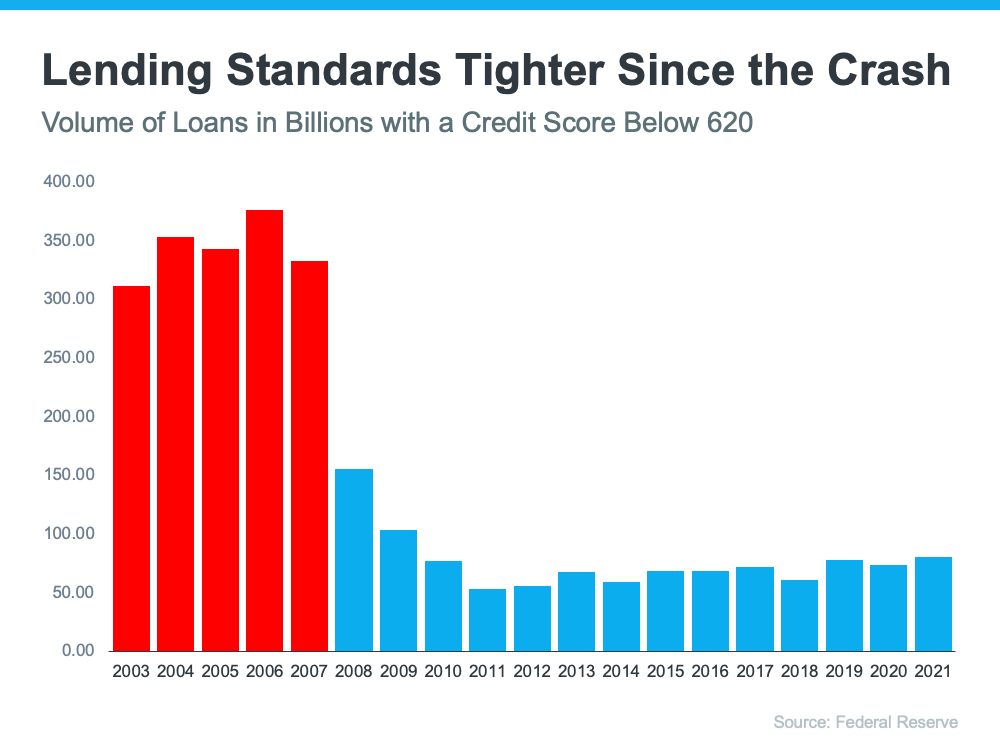

During the housing bubble, it was much easier to get a mortgage than it is today. As an example, let’s review the number of mortgages granted to purchasers with credit scores under 620. According to credit.org, a credit score between 550-619 is considered poor. In defining those with a score below 620, they explain:

“Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk.”

Buyers can still qualify for a mortgage with a credit score that low, but they’re considered riskier borrowers. Here’s a graph showing the mortgage volume issued to purchasers with a credit score less than 620 during the housing boom, and the subsequent volume in the 14 years since.

Mortgage standards are nothing like they were the last time. Purchasers that acquired a mortgage over the last decade are much more qualified. Let’s take a look at what that means going forward.

3. THE FORECLOSURE SITUATION IS NOTHING LIKE IT WAS DURING THE CRASH

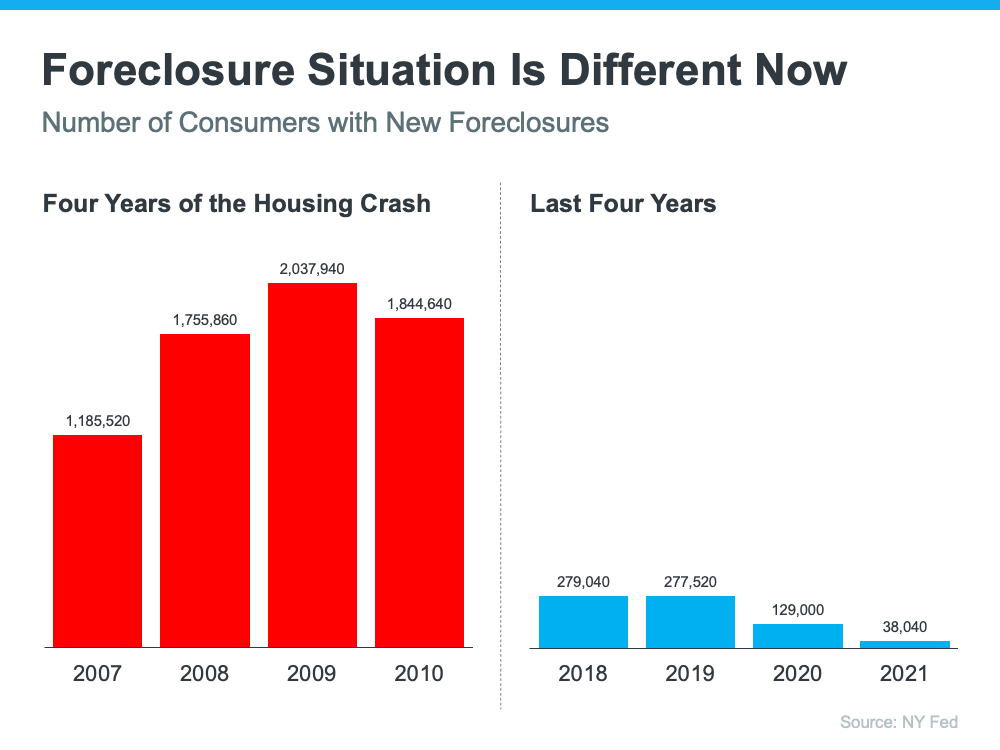

The most obvious difference is the number of homeowners that were facing foreclosure after the housing bubble burst. The Federal Reserve issues a report showing the number of consumers with a new foreclosure notice. Here are the numbers during the crash compared to today:

There’s no doubt the 2020 and 2021 numbers are impacted by the forbearance program, which was created to help homeowners facing uncertainty during the pandemic. However, there are fewer than 800,000 homeowners left in the program today, and most of those will be able to work out a repayment plan with their banks.

Rick Sharga, Executive Vice President of RealtyTrac, explains:

“The fact that foreclosure starts declined despite hundreds of thousands of borrowers exiting the CARES Act mortgage forbearance program over the last few months is very encouraging. It suggests that the ‘forbearance equals foreclosure’ narrative was incorrect.”

Why are there so few foreclosures now? Today, homeowners are equity rich, not tapped out.

In the run-up to the housing bubble, some homeowners were using their homes as personal ATM machines. Many immediately withdrew their equity once it built up. When home values began to fall, some homeowners found themselves in a negative equity situation where the amount they owed on their mortgage was greater than the value of their home. Some of those households decided to walk away from their homes, and that led to a rash of distressed property listings (foreclosures and short sales), which sold at huge discounts, thus lowering the value of other homes in the area.

Homeowners, however, have learned their lessons. Prices have risen nicely over the last few years, leading to over 40% of homes in the country having more than 50% equity. But owners have not been tapping into it like the last time, as evidenced by the fact that national tappable equity has increased to a record $9.9 trillion. With the average home equity now standing at $300,000, what happened last time won’t happen today.

As the latest Homeowner Equity Insights report from CoreLogic explains:

“Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they’ve also enabled many to continue building their wealth.”

There will be nowhere near the same number of foreclosures as we saw during the crash. So, what does that mean for the housing market?

4. WE DON'T HAVE SURPLUS OF HOMES ON THE MARKET - WE HAVE SHORTAGE

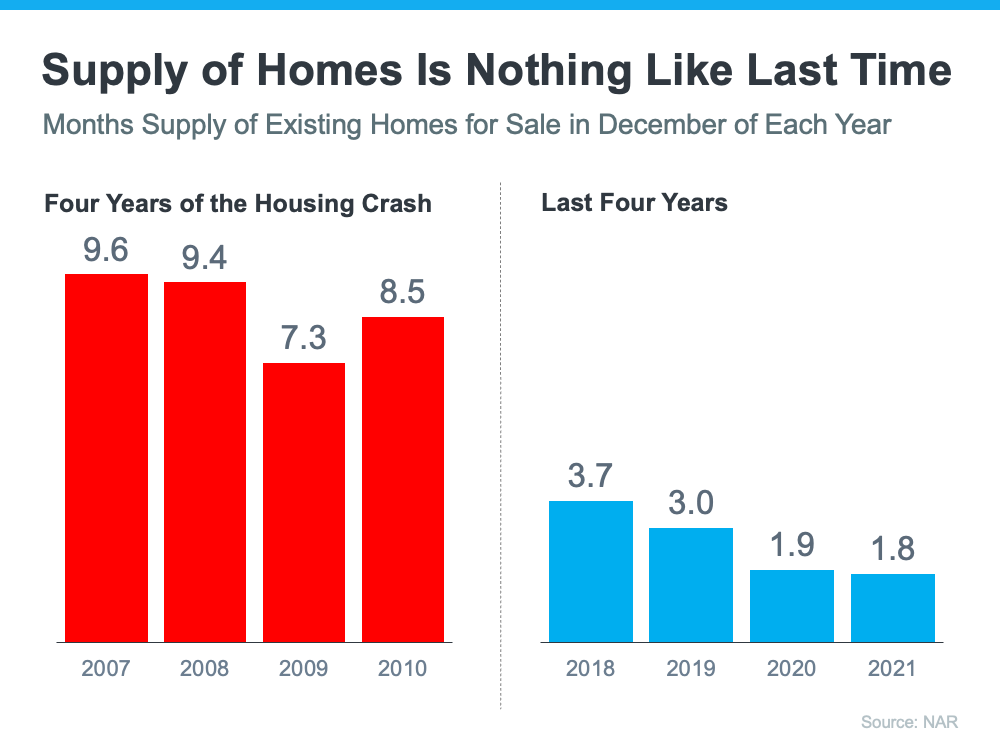

The supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued price appreciation. As the next graph shows, there were too many homes for sale from 2007 to 2010 (many of which were short sales and foreclosures), and that caused prices to tumble. Today, there’s a shortage of inventory, which is causing the acceleration in home values to continue.

Inventory is nothing like the last time. Prices are rising because there’s a healthy demand for homeownership at the same time there’s a shortage of homes for sale.

BOTTOM LINE

If you’re worried that we’re making the same mistakes that led to the housing crash, the graphs above show data and insights to help alleviate your concerns.

We see you out there… the For Sale sign is up in your front yard, people have come and gone to the open house (or maybe the open house had very little traffic which left you feeling defeated). You are seeing neighbors sell their homes after only a few days and wondering why you haven’t gotten that accepted offer yet. Here are a few reasons that the sign in your front yard still says For Sale. Or maybe you want to avoid being the seller who needs to read this blog post when the time comes for you to sell, and in that case, keep reading!

1) CONDITION

If your home is in need of some TLC, it can lead to a lack of buyer interest. Buyers in Seattle’s market want to be able to move right in and avoid taking on big projects, especially when it comes to maintenance. At a listing appointment it’s important for the agent to tour your home and make recommendations on things to consider repairing or replacing. You might want to consider making repairs such as new paint, new flooring or carpet, and cleaning up the yard. Many times, simple fixes can make a big difference to the eyes of a buyer.

2) LOCATION:

You’ve heard it before and here it is again: Location! Location! Location! People want to be in specific school districts, neighborhoods, a certain distance from light rail or maybe they want privacy. Many buyers put a BIG (yes, we’re emphasizing the word big) priority on the location of their new home. If your home is in an undesirable location, it’s going to need some help! When you take things like square footage, upgrades and condition into consideration, your home may be worth $850,000 in a popular area. However, if the location is not in top demand, you should consider adjusting the price to reflect that.

3) MARKETING:

When you put the location, the condition, and the price into perspective and those are all on target, it could be that your home isn’t being seen and needs more exposure to reach the right buyers. How is your home being marketed? A lot more goes into the marketing strategy of a new listing than sticking a sign in the yard and putting the home on NWMLS. How many internet views is your listing getting? Did you stage the home to make it feel warm and welcoming? Do you have professional photos that show your home in its best light? Is your home being marketed on social media to the buyers in your area? The more exposure your home has, the more demand it can create so marketing is a key piece of the puzzle to evaluate if your home is still sitting for sale.

4) PRICE

At the end of the day, the price is going to make or break whether or not your home sells. Ultimately the buyer and the market dictate the value of your home. The price you come up with based on the home features, size, location and upgrades could be slightly off from where you think it should be. The price of a home is not set in stone because “it’s the amount you want” or because “it’s reflecting how much money you’ve put into the house.” The value of your house is going to be determined by what a buyer is willing to pay for it. It’s important to have a plan in place as soon as you sign the listing contract so that you can evaluate the activity and adjust the price if needed. In most cases, if your home has been on the market for a few weeks and you haven’t had any showings, it’s a good indication that your home is priced too high. If you’ve had several showings but no offers, then you could just be slightly overpriced. Again, this depends on the status of your market and is ultimately determined by the buyer and what the market is doing.

There isn’t typically just one reason why your home isn’t selling, so make sure to keep these things in mind when you’re ready to list your home. If you’re thinking of selling and want to avoid ending up in this situation, we’d love to connect with you and walk you through the process in detail.

The Four Part Plan:

1) FOCUS ON SELLING A LIFESTYLE

You’re not just selling a house, you’re selling a lifestyle. Think beyond your “house data” such as square footage and room sizes. Highlight home features that resonate with the lifestyle buyers will get if they purchase your home.

Whether that’s entertaining space, smart home tech, a peaceful outdoor setting or a hotel like owner’s suite – you can optimize your space to show off the lifestyle and help potential buyers experience what it would be like to live there. Don’t forget about local amenities and nearby attractions!

QUESTIONS TO ANSWER:

1. Which room do you spend the most time in?

2. What is your favorite part about your community?

3. What is your favorite space in your home?

4. Which feature most attracted you to your home?

5. Do you have any rooms that should be shown in an alternative purpose (office vs. bedroom, etc)?

2) STAGE TO SELL:

PERSONALIZE & DE-CLUTTER

Take down the macaroni picture frames, family photos and sports trophies so that potential buyers walking through your home can envision themselves living there without being distracted. De-cluttering is also important. No one wants to see your “stuff” – they want to see the home features, your layout and how they can best use each room. So aim to have counters, dressers, desktops and shelves clear of any clutter!

ACCESSORIZE AS NEEDED

If your home is currently filled with family photos, you might need a few new accessories to add some style to your spaces. Look for neutral items such as a decorative wreath, a vase to put flowers in, a new front door mat, fresh rugs and towels in the kitchens and baths, new throw pillows for a splash of color and a plant for some greenery. It doesn’t have to be complicated!

LIGHTEN & BRIGHTEN

When it comes to making sure your home looks it’s best, the key is the brighter, the better. Some tips for lightening your space include: Adding mirrors to reflect light, washing windows and removing screens, updating light fixtures to something more modern and adding in lamps or accent lighting to dimly lit spaces. A reading lamp on a desk, under cabinet lighting in the kitchen and updated bathroom lighting can make a big difference without spending a significant amount of money.

APPEAL TO TODAY’S BUYERS

Know who you’re selling to and what their top wants and needs are. Many of today’s buyers are looking for separate laundry room spaces, designated office space, neutral paint colors, updated kitchens and baths as well as smart home tech. If you are able to add or highlight those features, you’ll be able to attract more interested buyers (which means increased demand for your home).

PRO TIP: Need some staging inspiration? Check out the Instagram accounts of some of your favorite home decor stores. Crate & Barrel, West Elm and Anthropologie have beautiful feeds showing different rooms and decor ideas. Also check out our Instagram Guide for our favorite options to decorate on a dime with Target.

3) HAVE A PRICING STRATEGY:

PRICE TO SELL

To generate the most demand, you’ll want to price your home to sell which means pricing it at or slightly below the market value. Your home is going to have the most activity when it first hits the market. Make sure you’re capturing the most buyers by pricing it right.

DON’T PRICE YOUR HOME ON THE HIGH END

Many sellers believe the myth that they should price their home on the “high end” so they have extra room for negotiation. The problem with this thinking is that it will attract less buyers right away and will increase the length of time your home sits on the market which can ultimately decrease your final sale price.

CHECK COMPARABLE PROPERTIES

Understand what is going on in your market. Your Real Estate Team can put together a Comparable Market Analysis which will compare your home to other homes on the market as well as recently sold homes. You’ll want to look at what features your home has compared to the other homes and make adjustments with your price as needed.

PLAN FOR ADJUSTMENT

Pricing your home is as much a science as it is an art. There are several variables to take into consideration as well as the ever-changing market. Make sure that when you list your home for sale, you and your Real Estate Team have a plan in place for 30 days out (or whatever makes sense for your market) to make a price adjustment if you’re not getting the activity you should be getting. Having this in place from the get go will help you feel prepared and prevent your home from sitting on the market for too long. Remember the longer a home sits on the market, the less attractive it looks to potential buyers and the more they think they can “get a deal”. You’re better off to make a price adjustment before you get to that point.

4) HIRE THE RIGHT TEAM

HIRE THE TEAM WHO FEELS LIKE THE RIGHT FIT

Before interviewing a real estate broker, look them up online. Check out their social media profiles and their “About” section. This should help give you an idea of what it will be like to work with them before you even meet with them. That’s a good start. Then, when you meet with them, consider how their personalities will work with yours. How will they interact with other agents, what are their negotiating styles and how do they communicate? You’re going to be spending a lot of time talking to them so you’ll want to hire a team that you connect with.

SEEK OUT A TEACHER NOT A SALESPERSON

“You don’t want someone with the heart of a salesman, you want someone with the heart of a teacher.” – Dave Ramsey. Working with a team who has the heart of a teacher will help you understand the process and set you up for success. They won’t be pushy and make you feel pressured. They will instead give you options and explain what outcomes they could result in.

SOCIAL MEDIA SAVVY

Marketing your home on social media should be a KEY piece of their marketing strategy. Check out their Facebook page or Instagram account to see if they’re active on social media. You’ll want to hire a team who is utilizing these modern marketing methods in order to maximize your home’s exposure and reach as many potential buyers as possible. Keep in mind, often listings are marketed with Facebook ads, so you may not see actual listings on their feeds. But you’ll want to check if they are active on their platforms and then ask them about their strategy when you meet with them.

Thinking of selling your home? Let’s connect!

The thought of buying or selling a home can be intimidating . . . the idea of doing both simultaneously can be downright overwhelming. Should you buy first? Should you sell first? Should you rent in between? With the recent impact of COVID, now more than ever, our clients are seeking the opportunity to upsize to larger spaces. Here are 4 steps we recommend to help guide you through the process:

1) CONTACT A LENDER

Before you make any major decisions on your home transition, the first and most important step to take is to speak with a lender about your options. There are various programs available to consider including a bridge loan or a HELOC. It will be important for you to understand all of your options prior to making an offer on a new home.

WHAT IS A BRIDGE LOAN?

A bridge loan allows you to make a non-contingent offer on a new home by borrowing on the equity of your current home. Sellers with the right amount of equity (the difference between what your home could sell for and your mortgage balance) could qualify for a low-cost loan with no monthly payments that becomes due when the current home sells. Through Windermere’s exclusive partnership with Vintage Home Loans, our sellers are able to buy first, vacate their current home and then sell, making for a seamless and stress free experience. A bridge loan typically takes 30 days to process and close.

WHAT IS A HELOC?

A Home Equity Line of Credit (HELOC) is a revolving source of funds, much like a credit card, that you can access as you choose. Like the bridge loan, a HELOC also allows you to make a non-contingent offer on a new property. The loan is secured against the value of your home based on the amount of equity you hold. The interest rate is typically higher than your standard mortgage, and you will be required to make monthly payments on the loan. A HELOC typically takes 45-60 days to process and close.

WHAT CAN YOU AFFORD?

As you explore loan options the final step will be to gain full approval on a new loan to purchase a home. Your real estate broker will provide you with a list price for your current home which will be important for your lender to have. Based on this information, they can review your credit history and income to determine what the budget for you new home will look like. Make sure to get a loan approval letter prior to shopping for the new house.

2) KNOW YOUR OPTIONS:

If you are in a tight real estate market such as Seattle, trying to make a contingent offer (making an offer on a home with the contingency that it will close once you sell your existing home) is nearly impossible when you want to compete in this market. So, you need to consider your options:

BUY BEFORE YOU SELL

If you have down payment funds saved up, or obtain a loan, you may be able to begin your home search now. Having the ability to buy first, then move into the new home in order to vacate the current home before selling, is the most ideal situation.

SELL BEFORE YOU BUY

It is possible you may not be able to qualify for an advance loan. When this happens, you most likely will need to sell before you buy. That said, living in a home while it is on the market, especially during COVID, greatly reduces your chances of multiple offers. If you are in a high demand market such as Seattle, you may be able to vacate the home for 1-2 weeks, sell, and then return home until closing. Consider staying with family, or a short-term Airbnb, or better yet take the mental health vacation you’ve been pining for. We love these unique and local recommendations from SeattleMet

RENT, SELL, THEN BUY

Moving is stressful, and living in temporary housing may not be an option, especially if you have kids and pets. This is when you should consider moving into a short-term rental. Not only will you have better selling results by vacating the property, but it will also allow for more flexibility and less pressure when it comes to timing the closing on a new home.

(You may notice that the biggest tip here is to vacate before you try to sell.)

3) PREPARE THE PROPERTY:

Once you have determined the best option, you’re ready to put your plan into action. Here are a few tips to consider while preparing the property:

MEET WITH YOUR BROKER

Have your real estate broker tour the home and help determine what updates or repairs are needed to give you the highest ROI (Return on Investment). Most professional brokers will have a list of vendors that can assist you with these projects.

DETERMINE LIST PRICE

Once your broker has done a walk through, they will provide you with a market analysis of the neighborhood, comparable properties, and a potential list price for the home. When considering a list price, it is crucial to listen to the market, not your heart. We all have a price we want, but that might not be achievable. Be realistic about what your home is worth so that it will sell quickly and efficiently.

STAGE THE HOME

Trust us, stage. It’s an expense but the return on investment is tenfold! In facet, Forbes.com reports that staged homes statistically sell 87% faster and for 17% more! Homes that are empty feel cold, not welcoming, and buyers are challenged with envisioning how to layout the rooms. Staged homes feel cozy, inviting, encouraging the potential buyer to stay a while and explore more.

HIRE AN INSPECTOR

In a fast market where you may only need a week to sell, it might be a good idea to hire a home inspector who can provide an inspection report to potential buyers. This not only reduces impact on the home with just one inspection instead of multiple, it allows for potential last-minute buyers to jump in with an offer. If you are on a public sewer line, it might be a good idea to have the line scoped (where they stick a camera down the entire line) and inspected. By providing a full home inspection report, buyers will be more likely to waive the inspection contingency and therefore you have one less loophole in your contract.

4) GO SHOPPING!

Now that you have researched your finance options and have a plan for preparing your home to sell, you are ready to get out and tour. Knowing what you are looking for in a new house and expressing the details to your broker will contribute to your success. We recommend a brainstorm session such as our Buyer Worksheet to help get you started. Download and print a copy for everyone in the household, then compare your results.

Buying and selling a home at the same time can be hectic and stressful, but hiring a professional full-time, full-service real estate broker will help ease much of this pressure. Make sure you choose to work with an experienced agent who has managed the upsizing process before. They will be the key ingredient to your success!

Let’s be honest, six months ago, none of us imagined we’d be where we are today. While last spring was filled with coping strategies and beliefs that this was all just “temporary,” the new reality is we are in this for the long haul. Here in Seattle, most schools have moved to an online platform for Fall. Which means parents, and especially working parents, continue to carry the load. If you’re like us, last spring was filled with moments of popcorn for dinner and philosophical ideas on how early was “too” early for happy hour.

With the first day of school just a few days away, it’s time to shift and accept. Accept that we need to gain a sense of control over our family lives and shift to a new normal. We have compiled a list of suggestions on how you might get through this, but only you can decide what will help you survive best.

1) YOU FIRST:

Just as the airlines instruct us to don our oxygen masks first before helping others, home school parents must prioritize their needs first. Let’s be honest, once the kids are up and the coffee is brewing, your opportunity for “me” time is thrown out the door with Monday’s recycle bin. So, consider waking an hour earlier for the special “me” time that allows you to be your best self. Quietly meditate, practice your living room yoga, or head outside for a mind clearing walk/run. While it means one less hour of sleep, putting yourself first will help center your focus on others for the rest of your day.

2) START THE MORNING RIGHT:

Ever since our daughter was little, we have always insisted that she brush her teeth, comb her hair, and change her underwear before she leaves the house. Even in the chaos of COVID, this basic requirement was the one thing that we held to in efforts to keep some sort of normalcy with our mornings. By establishing a morning routine, even in COVID, we are setting the precedent that now is the time to start their day. Pro parent tip: Just as we did when school was in person, consider continuing the morning prep routine while they eat breakfast such as filling their water bottle, putting together a snack and making their lunch. Send the water bottle and snack to their home school desk and leave the pre-made lunch in the fridge for easy access. Prepping in the morning allows for a lot less last-minute disruption with the never ending “I’m hungry!”

3) PLAN THE WEEK:

We love this printable meal planning calendar that our friends at Satsuma Designs put together. By encouraging the kids to take the lead on lunch, your success rate might reach 90% (percentages suggested, not guaranteed). Also, consider spending an hour on Sunday prepping grabbable snacks. We recently discovered Eazy Peazy Mealz for kid friendly, easy to access lunch items as well as Sunday Family’s for snack station ideas.

4) RECESS:

Remember how our teachers send their students outside, rain or shine, two to three times a day? Why aren’t we? Yes they’ll be cold and wet, but this is school! Store a plastic crate on your porch filled with balls, frisbees, mitts and more and send the kids outside. Set a recess schedule with alarms on your phone or iPad that remind the kids it’s time to go outside. If you have a neighbor pod, coordinate timing for all the kids to recess together and take turns for recess duty (Kahlua spiked coffee in tumbler optional).

5) TIME OUT:

Do you remember the sheer joy in your younger years when the AV volunteers rolled in the TV/VCR cart? Teachers used movies to get a break, so why can’t we? Do you have an important conference call coming up? Need a shower? Or just want to lock yourself in the bathroom for 30 minutes? You deserve a “guilt free” break today, so make the best of it! Check out the website Teach With Movies which is chock-full of educational movies for every age.

6) FIELD DAY:

Engage your children to remember what was their most favorite day at school. Crazy hair day, field day, pajama day, breakfast for lunch day? Review the calendar and plan out a few themed Fridays to get the kids excited about the week and something to look forward to. Participate with them and just let your Zoom colleagues know that yes, you did shower, but it’s Crazy Hair Day!

7) IT TAKES A VILLAGE:

This pandemic has truly sucked for EVERYONE! Now more than ever, we are all seeing the value of social interactions for our children. If you haven’t done so already, consider creating a pod with another family or classmate with similar values around virus protection. Setup a schedule for virtual learning together and take turns hosting at each other’s house throughout the week. If you have multiple aged children, break up the sibling rivalry by having one family host the older children while another manages the young ones. Home school virtual learning is lonely for all of us. By creating a pod, your children will thrive from the social interaction and you just might get a much needed break.

8) EMERGENCY TOOL CHEST:

Teachers have an emergency backpack in their room, you need one too. But consider this less of an earthquake survival kit and more like a daily existence tool chest. Even with remote learning, early release days still exist. So, when the important Zoom meeting is scheduled for Wednesday at 2pm, you’ll need backup forces to help entertain the kids. Here are a few Netflix-free ideas to implement:

- Outschool – affordable online classes to learn anything from the latest TikTok dance to tween yoga.

- Duolingo – fun games and daily rewards for students wanting to learn from more than 30 different languages including Klingon, Swahili or High Valyrian.

- StoryLine Online – professional actors the likes of Kristen Bell, Kevin Costner and Angela Bassett read aloud popular story books.

- National Geographic Kids – provides a collection of videos and activities centered around animals.

- Crazy Little Projects – crafts, cooking and more to entertain all ages.

- Math Support – if there is one thing we learned in COVID, long division is no longer a thing. We’re still not quite clear what it is they are doing, but this list of math tools will provide frustration free help.

While last spring’s performance was well justified with survive and cope techniques, Fall’s virtual learning platform is an opportunity for us to create a consistent plan where our children have potential to thrive. The key to success is accepting that not every day will be perfect, that we must learn how to give ourselves grace, and as our friend Elisa recommends, “set boundaries, especially space.” If all else fails, our friend Carrie suggests keeping a supply of dark chocolate on hand while our friend Cassandra recommends day drinking. You decide what works best for you.

Even with COVID restrictions, the Seattle real estate market continues to be very strong. We find that our sellers who follow these 5 steps are more successful in this market, often selling over list price with multiple offers. While your market may be faster, or slower, than Seattle, in the time of COVID, it is best to be prepared.

-

VACATE YOUR HOME:

Selling a home that is occupied is challenging enough, let alone in a global pandemic. For the safety of you and your family, it’s best to not reside in the home while it is on the market. If you are in a faster market such as Seattle, you should be able to sell your home within a week which means it’s the perfect time to book an AirBnb vacation. Or consider purchasing/renting your next home first, move in, and then list your property for sale.

-

PRE-MARKET PREP:

An experienced broker will walk through your home and provide you with a list of updates and repairs that should be done before you go to market. In our COVID market, buyers are looking for a home to move in to right away. They are not excited about projects, and will often skip over the home that needs repairs to pay more for the home that is move-in ready. The difference between selling quick with a multiple offer situation starts with first impressions. Make sure yours is the best possible first impression you can make.

-

PPE:

If you are going to be living in the home while it is on the market, make sure that you or your broker are supplying PPE supplies for buyers when touring. This includes face masks and hand sanitizer. Be prepared to sanitize bathrooms, door handles and any other surfaces that may be touched after you return home each day.

-

VIRTUAL TOURS:

Make sure to ask your broker about their marketing plans to feature your home to the most buyers. In addition to professional photos, find out if they offer measured floor plans and 3D virtual tours. Most importantly, since open houses are still not allowed in most cities including Seattle, ask if your broker will conduct a live-feed open house to prospective buyers. We recently invested in a Insta 360 Nano S camera and love how it can feature the home while we tour (see an example of our most recent tour here).

-

HIRE A FULL-SERVICE EXPERIENCED BROKER:

Having to work with new COVID restrictions and a finicky market, now is not the time to hire your dog walker’s cousin who just got their license, or a discount broker. Now, more than ever, you need the assurance that your property is represented in its best light with maximum exposure. When interviewing a potential broker, you may want to ask them:

- How many homes have you sold in COVID?

- Have you successfully listed AND sold houses in COVID? How many had multiple offers?

- What are buyers looking for right now?

- How do you market and promote your listings given open houses are not permitted?

- Do you provide 3D tours?

- Do you require a seller provided pre-inspection of the home and sewer line?

- What is your plan for offer reviews?

Taking these tips into consideration will help support a successful sale. Thinking of selling? Let’s connect and help you get started.

On March 23rd, our world in the State of Washington changed as we know it. As we all hunkered down into our homes, many of us realized that perhaps it was no longer the “right” home. With more free time available, and little to do but shop online, we have noticed an uptick of interest among Seattle home buyers.

Prior to the impacts of COVID-19, Seattle’s real estate market was in full force. We saw a slow down after Gov. Inslee’s Stay at Home Order went into effect, but once real estate was deemed an essential service, we were back in action. While there are strict guidelines in place on how and when we can show homes, we continue to see multiple offers on homes that are in tip-top shape and priced accordingly.

In other words, there are no great “deals” to be had right now in Seattle. And now, more than ever, buyers need to be prepared. Here’s a few tips and tricks for success in Seattle’s real estate market during the time of COVID:

-

KNOW THYSELF:

It’s time to take a deep dive into your home ownership desires and truly understand your wants and needs. With the current restrictions, gone are the days of open houses and full day tours. In fact, your broker may only be able to show you 2-3 properties in person. So it’s crucial to be laser focused on what you really want. Try using a helpful tool like our Buyer Brainstorm to explore all of the characteristics in a home that you might want to consider. If you have a spouse or partner purchasing with you, have them fill out the Buyer Brainstorm separately, then compare and contrast.

-

GET APPROVED:

At this point, no real estate broker is going to take on the risk of public exposure if you are not fully pre-approved for a loan. The loan application can almost entirely be processed online and you will receive the knowledge and assurance that you can afford the right home. Ask your friends, colleagues, family or your real estate broker for lender referrals. Most importantly, you should be working with seasoned mortgage broker who has experience with lending in challenging times and is willing to answer your call on a Saturday.

-

FIND AN EXPERIENCED REAL ESTATE BROKER:

Now is not the time to work with your cousin’s dog walker who just got into real estate. More importantly, working with a discount brokerage will more often than not, cause you to lose money in the long run. Let’s be honest, the market is still active, but it’s challenging . . . very challenging. You need a full-time professional broker on your side advocating for you every step of the way. Ask your friends, family and colleagues for a referral. Then check their online reputation. How are their reviews on Google or Zillow? Have they given attention to their website? If they can’t be bothered with presenting themselves professionally online, how well will they represent you?

-

BE INTENTIONAL:

Because public open houses are not currently permitted, your opportunity to explore options is limited. While some listings have virtual open houses or 3D tours, you can be proactive by first driving by properties of interest before scheduling showings. Explore the surrounding neighborhood amenities to ensure it has your list of requirements. While there, use Google’s Commute tracker to ensure the commute will be livable once we are all back to “normal.”

-

KNOW THE RULES:

As of today, only two people are permitted to view a home at once, one of which is your real estate broker. You must wear a mask, and will be asked to sanitize hands as you enter. You may also be asked to fill out a survey of your health history and exposure to anyone who has tested positive for COVID-19. Each showing is by appointment only, and limited typically between 15-30 minutes. It is important to remember that we are all under the same restrictions and need to practice extra patience, understanding and flexibility.

The good news is that inventory is up and there are several opportunities for Buyers. With knowledge and patience, you can be successful in this market. Ready to explore home buying in Seattle? Download our Buyers Guide outlining our simple 8-Step plan to home ownership and contact us to setup a Zoom intake call.